We may still be in a secular bear market, as will be discussed later, but for now, I think we have seen a bottom.

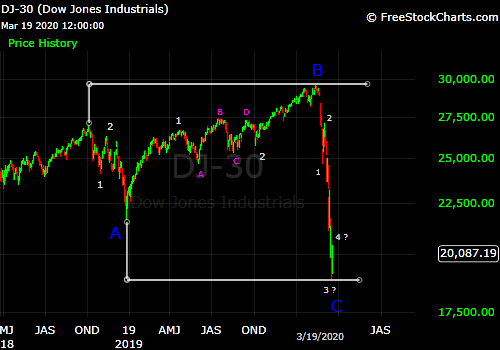

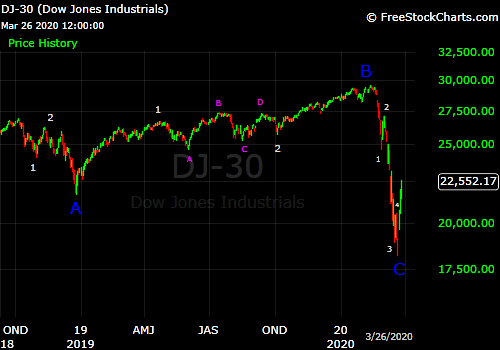

The rally from the 3/23 low on the Dow Industrials is over twice as large as the rally during 2/28 – 3/4. After faltering around the .382 Fibonacci retracement level of the 3/4 – 3/23 crash during the 3/25 trading session, the Dow surged above that level on 3/26 and established itself above that level. Given that it is possible to find five waves down from the 2/12 high to the 3/23 low as shown on the chart, and the current rally seems rather disproportionate to the rest of the C wave, I am in favor of saying that the crash low is behind us.

A retest of the low is very possible, but it should form a higher low even if just marginally.

At the low on 3/23, the Dow was down 38% from the most recent record high. Compare that to the stock market drops associated with the five most recent recessions:

2007-09: 54%

2001: 39%

1990-91: 22%

1981-82: 25%

1980: 21%

Average of last five recessions: 32%

Median of last five recessions: 25%

So, the recent 38% drop on the Dow should be sufficient to price in a recession. One could argue, however, that because the market drop began only 1.5 months ago, and it is still unclear how long and deep the economic contraction will be, there is still too much uncertainty about the future for the market to form a bottom. I would agree with that, were it not for the fact that a broader bear market pattern appears to have begun in 2018. Basically, from October 2018 onward, the prospect of a coming recession was weighing on investors’ minds and the market activity reflected that. Thus, at the Feb 2020 top, the degree of bullish sentiment that would have to be eroded in order to form a bottom amid the crisis we are in now was not as great as you would normally have at a major market top. Consequently, the bottom would be able to come sooner than usual.

This brings us to the next point, what is the long term outlook for the stock market now? Looking at my Elliott Wave count from 2018:

We have what appears to be a complete Elliott Wave expanded flat pattern from Oct 2018 to March 2020. That is a duration of only 17 months. Over the past century, the shortest period of time that I have classified as “bear market” was 29 months (1960-62). Thus, we may still be in a secular bear market. If that is the case, the Dow would likely rally to a point in between the tops of Oct 2018 and Feb 2020, then go into an Elliott Wave zigzag or triangle pattern lasting another 1-2 years, but would remain within or near the general range established during Oct 2018-present. Then the whole bear market pattern would form an Elliott Wave Combination.

Whether the secular bear market continues will probably be determined by the strength of the economy following the rebound from the current contraction.